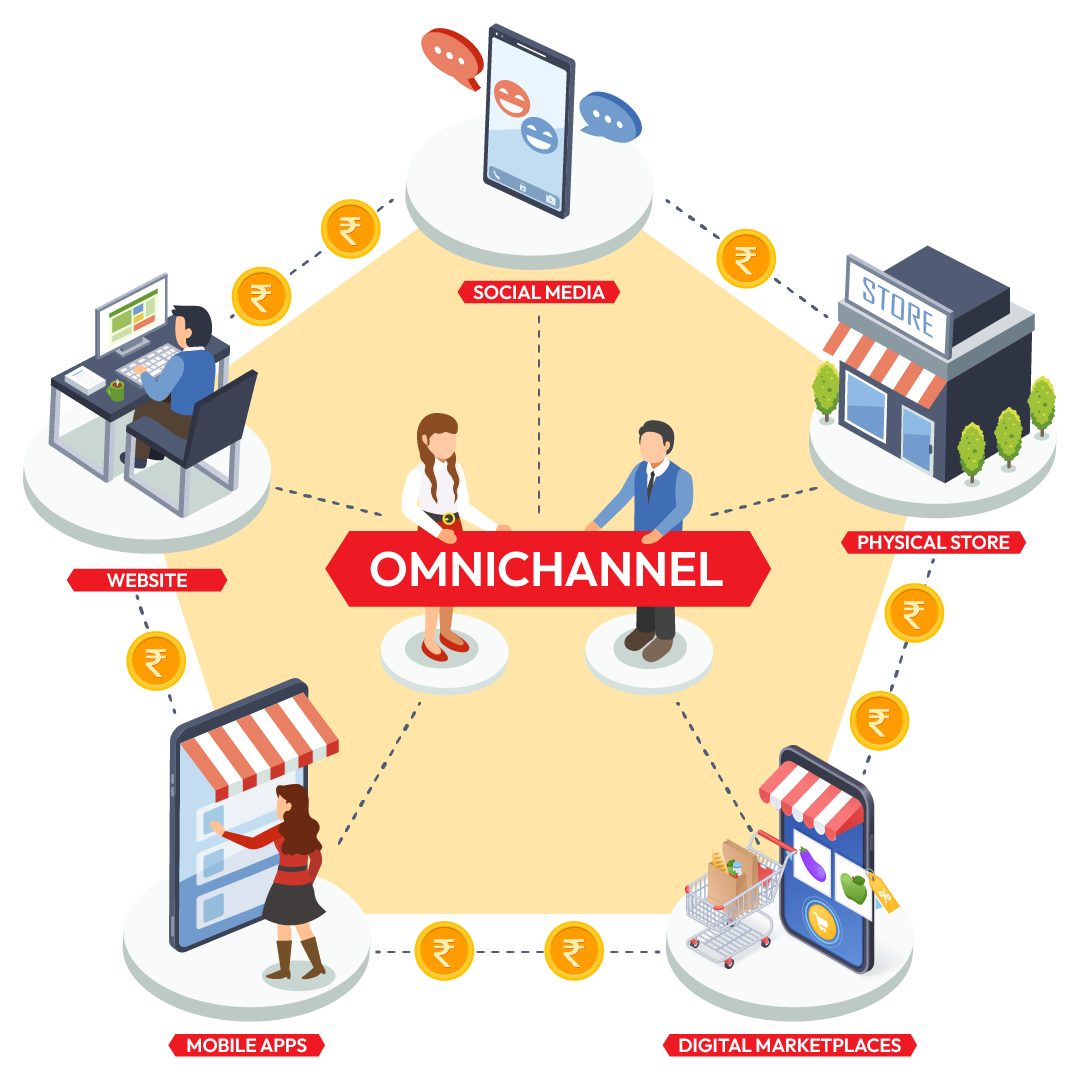

Omnichannel Marketing, the buzzword trending with Start-ups,’ Retail Chains, and the Big Tech is primarily a prerogative of the FinTech industry. Let us begin with a basic understanding of the term ‘Omnichannel Marketing.’ It refers to seamless mobility of user experience between different channels of operation- Brick & mortar stores, website, mobile apps, various digital marketplaces, etc.

It is important to understand the difference between Omnichannel and Multichannel Marketing. Omnichannel marketing for a brand refers to a unified, connected, and overlapping user experience across several different channels. Whereas Multichannel marketing refers to the mere presence of a brand across multiple channels that does not offer a unified user experience to the customer.

How to monetize Omnichannel marketing?

The number of touch points in a customer journey from a trigger point to purchase point is multitudinous. In omnichannel marketing, every touch point of a customer is a potential trigger or purchase point. According to Google, Behavioral science suggests sending the wrong signal at the wrong moment during a customer purchase journey could be highly disruptive, leading to the offering brand being jettisoned from the shopper’s consideration set. The right omnichannel marketing strategy helps identify and monetize the right purchase points.

The successful implementation of omnichannel marketing for a business is a resource and cost intensive undertaking. Although there are remarkable advantages to implementing omnichannel marketing especially for Offline-to-Online (O2O) startups, the seamless user experience is only achieved by using the right payment tools. Here are 3 Payment Features every omnichannel business should have.

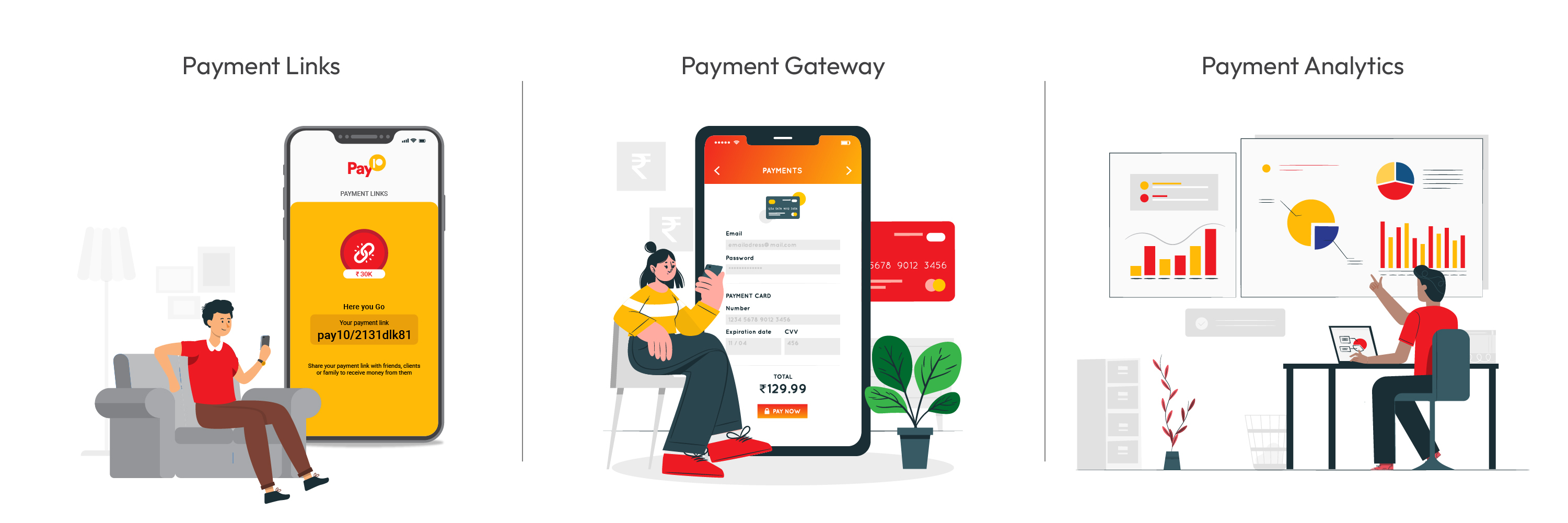

- Payment Links

- Payment Gateway

- Payment Analytics

The quickest way for a business to adapt digital payments is to use Pay10 Payment Links. The versatile payment method can be of remarkable use for offline businesses, online businesses that rely on social media marketing, omnichannel businesses that have touch points in instant messaging apps such as WhatsApp or Telegram or even a Chatbot. Payment Links enable customers to simply click and pay using any payment option including credit/debit card, net banking, UPI (Unified Payments Interface), Wallets, etc.

Businesses can no longer afford to employ online business as an ‘add on’ to brick & mortar stores or other traditional business models. The modern-day customer expects every purchase, is verified, and validated by users online. The omnichannel marketing approach to creating business strategy begins with a device agnostic, pliable payment system that acts as a unifying factor across diverse platforms.

Payment Gateway offers seamless payment experience that supports several different payment modes such as credit/debit cards, net banking, UPI, etc. The customer can breeze through a harmonious payment experience connecting the brand’s brick & mortar store, website, mobile app, social media platforms, and digital marketplace. All the touch points seamlessly interconnect with a secure, unified, and reliable Payment Gateway, reducing the churn rate and boosting the number of sale conversions with ease.

The customer journey and purchase behavior have become complex and chaotic as the digital realm expands its horizons with each passing day. The boundaries across sectors have ceased to exist, as the increased mobility of customer between platforms both online and offline becomes more fluid with each new innovation. This increased fluidity in customer journey generates overwhelming number of data points at each trigger or purchase point.

Payment Analytics offers an all-in-one solution to quickly chart the multitude of data points and aids businesses to derive precise information that is required, at any given point of time. There are several filters to choose from, as payment analytics become easy and hassle-free. The wealth of relevant and quickly accessible data points available on the Pay10’s analytical dashboard can be used to make key business decisions and help drive a winning business strategy.

Pay10 offers the right payment solution for businesses with omnichannel marketing. The device agnostic Pay10 Payment Gateway seamlessly connects and unifies all the touch points of a customer journey, for a business that straddles the online and offline marketing channels. Launch omnichannel marketing for your business today with pay10’s ultra-efficient Payment Gateway with top-of-the-line security features, supporting several payment modes, and powers an analytical dashboard; Payment Links, Billing service, Reseller services, Payout services, and more.